The Data Accessibility Challenge

Modern banks operate across multiple systems – from core banking and CRM to payments and compliance platforms. While these systems house valuable data, the inability to access this information quickly and efficiently creates bottlenecks in decision-making and customer service delivery.

Traditional data architectures, despite their robustness, often struggle with:

Real-time data access across distributed systems

Unnecessary data duplication

High maintenance costs

Complex compliance requirements

Integration challenges with fintech partners

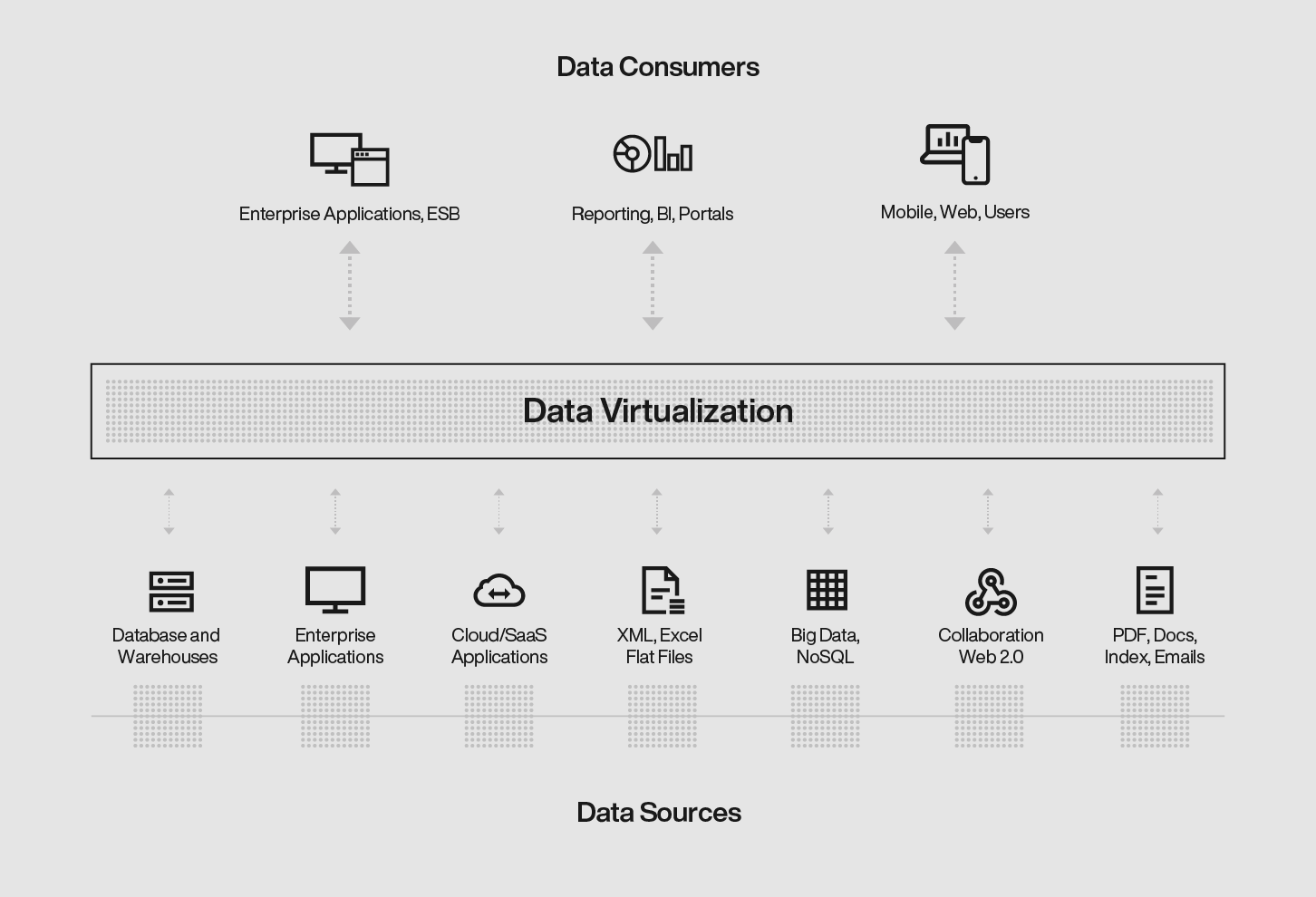

Data Virtualization: The Strategic Solution

Data virtualization emerges as a transformative solution, enabling banks to create a unified data access layer without the need for physical data movement or replication. This approach revolutionizes how financial institutions manage and utilize their data assets.

Key Architectural Components

Multi-Tiered Architecture (Platinum-Gold-Bronze)

Structured access to both real-time and archived data

Optimized storage and retrieval based on data usage patterns

Efficient resource allocation across different data tiers

Real-Time Processing Capabilities

Low-latency query processing for critical operations

Enhanced AI-driven fraud detection systems

Real-time credit risk assessment and analytics

Regulatory Compliance Framework

Automated compliance monitoring and reporting

Built-in support for GDPR, PCI-DSS, and Basel III requirements

Secure, role-based access control mechanisms

Open Banking Integration

API-first architecture for seamless fintech integration

Secure data sharing capabilities

Standardized data access protocols

Measurable Business Impact

Implementation of data virtualization delivers significant, quantifiable benefits:

Operational Efficiency

30% acceleration in decision-making processes through AI-powered analytics

Substantial reduction in cloud storage costs

Elimination of redundant data storage

Customer Experience

Real-time personalization capabilities

Instant fraud detection and alerts

Enhanced financial advisory services

Improved customer satisfaction through faster service delivery

Regulatory Compliance

Streamlined compliance reporting

Automated audit trails

Enhanced data governance

Reduced compliance-related operational costs

Future-Proofing Banking Operations

As the financial services industry continues to evolve, data virtualization becomes increasingly critical. Banks that implement this technology gain significant advantages,

Enhanced Agility

: Faster response to market changes and customer needs

Improved Innovation

: Easier integration of new technologies and services

Cost Optimization

: Reduced data management and storage costs

Better Risk Management

: More accurate and timely risk assessments

Implementation Strategy

For banks considering data virtualization, we recommend a phased approach:

Assessment of current data architecture

Identification of high-priority use cases

Pilot implementation in selected departments

Gradual rollout across the organization

Continuous monitoring and optimization

Conclusion

Data virtualization represents more than just a technological upgrade—it’s a strategic imperative for banks aiming to compete in an increasingly digital financial landscape. By enabling real-time access to critical data while maintaining security and compliance, data virtualization helps banks deliver the agile, personalized services that modern customers demand.

The future of banking lies in the ability to harness data effectively, and data virtualization provides the foundation for this transformation. Banks that embrace this technology now will be better positioned to lead in the era of digital financial services.